IoT adoption in DACH manufacturing: How Germany, Austria, and Switzerland lead Industry 4.0

Discover how Germany, Austria, and Switzerland manufacturers use IoT to cut downtime by 28-40% and create new revenue from connected equipment.

The DACH region (Germany, Austria, and Switzerland) represents Europe's manufacturing powerhouse. With over 100 million inhabitants and a combined GDP exceeding $5.3 trillion, these German-speaking nations stand at the forefront of industrial innovation. As the birthplace of Industry 4.0, the DACH countries are leading the global transition to connected, data-driven manufacturing.

But IoT adoption in this region looks different than anywhere else. The dominance of family-owned SMEs known as the Mittelstand, stringent quality standards, and complex cross-border operations create unique opportunities and challenges. This article explores how DACH manufacturers are implementing IoT technologies, the business outcomes they're achieving, and what separates leaders from laggards in the race toward smart manufacturing.

Understanding the DACH Manufacturing Landscape

Before diving into IoT adoption, it's essential to understand what makes DACH manufacturing unique. This isn't Silicon Valley's "move fast and break things" culture. It's a region where precision engineering, multi-generational expertise, and quality-first thinking define industrial success.

The Economic Powerhouse of Central Europe

The DACH region's manufacturing sector combines scale with specialization in ways few other regions can match:

Germany stands as Europe's largest economy with over 84 million people and a GDP exceeding $4.5 trillion. Manufacturing accounts for roughly 20% of German GDP, with particular strength in automotive, machinery, chemicals, and precision engineering. The country's Industrial IoT market is projected to reach $12.76 billion by 2029 , growing at a 10.54% CAGR.

Austria contributes a GDP of approximately $512 billion with 9 million inhabitants. While smaller, Austria punches above its weight in specialized manufacturing, technology, and engineering. The country serves as a crucial bridge between Western and Eastern European manufacturing ecosystems, with strong trade relationships extending into Central and Eastern Europe.

Switzerland boasts one of the world's highest GDP per capita figures despite its small population of 9 million. Swiss manufacturing focuses on high-value products where precision matters most: pharmaceuticals, medical devices, precision instruments, and luxury goods. The "Swiss Made" label commands premium pricing globally based on decades of quality reputation.

Together, these three countries form an integrated manufacturing ecosystem. The Mittelstand landscape comprises over 3 million companies employing around two-thirds of the workforce. These aren't just statistics. They represent family-owned businesses, often spanning multiple generations, that have perfected specialized manufacturing processes and become world leaders in narrow product categories.

Industry 4.0 Leadership

Germany didn't just adopt Industry 4.0; it created the concept. The term emerged from a German government strategic initiative announced at the 2011 Hannover Messe , positioning smart manufacturing as the fourth industrial revolution following mechanization, mass production, and automation.

This wasn't marketing hype. It represented a coordinated national strategy involving government funding, research institutions, and industry collaboration to maintain manufacturing competitiveness in an increasingly digital world.

The results speak for themselves. According to Germany Trade & Invest , Germany maintains the highest industrial robot density in Europe with 415 robots per 10,000 employees. The country's robotics and automation industry is forecast to reach €16.5 billion in turnover for 2024. Perhaps most tellingly, 9 out of 10 companies currently use or plan to use Industry 4.0 applications .

Austria has developed its own digital manufacturing initiatives, with particular emphasis on cyber-physical systems security through programs like IoT4CPS . The country's strategic position and strong technical universities make it an innovation hub for manufacturing technology startups serving the broader DACH region.

Switzerland approaches Industry 4.0 with characteristic precision. Major Swiss manufacturers like ABB have implemented advanced automation and data analytics throughout their operations. Switzerland leads in adoption of lean manufacturing principles combined with cutting-edge technology, creating highly efficient production systems that maximize output while minimizing waste.

The Mittelstand Challenge

Here lies the paradox at the heart of DACH manufacturing digitalization. Despite years of Industry 4.0 promotion and COVID-19's acceleration of digital transformation, adoption of digital technology among manufacturing SMEs in the DACH region still lags behind large enterprises.

Why do companies that excel at mechanical engineering sometimes struggle with digital transformation?

Financial Constraints

IoT implementations require upfront investment in sensors, connectivity infrastructure, and software platforms. For a family-owned manufacturer with 50-200 employees, these costs compete directly with machinery upgrades and working capital needs. When every euro is scrutinized, proving ROI before spending becomes essential.

Technological Complexity

Many Mittelstand companies operate heterogeneous machine parks with equipment from different generations. A CNC machine from 2005, a press from 1998, and a new robotic cell from 2023 all need to communicate, but they speak different languages and use incompatible protocols. Retrofitting connectivity to older equipment often costs more than the original equipment purchase price.

Skills Shortage

Approximately 40% of German manufacturing firms struggle to find workers skilled in AI and robotics, according to the German Federal Ministry of Education and Research. When your experienced machine operators understand mechanical systems but not data analytics, bridging that gap requires significant investment in training.

Conservative Culture

Many manufacturing SMEs maintain a deep-rooted focus on physical products and incremental improvements rather than transformative digital change. Leadership teams often prioritize machinery upgrades over software investments. When you've built a successful business on precision mechanics and craftsmanship, treating data as a core asset requires a fundamental mindset shift.

Despite these challenges, Mittelstand companies are beginning to embrace IoT as competitive necessity rather than optional enhancement. The question is no longer "if" but "how" and "how fast."

Current State of IoT Adoption in DACH

The DACH region is moving from Industry 4.0 theory to practical implementation. Real factories are installing sensors, connecting equipment, and using data to drive decisions. But adoption rates vary significantly by industry, company size, and country.

Adoption Rates and Trends

Recent research reveals the extent of IoT's penetration into DACH manufacturing:

According to a survey of 683 C-level executives in the DACH region, IoT ranks as a critical technology across multiple industries:

- Manufacturing/Production: 89.1% of executives consider IoT important for organizational success

- Transportation & Logistics: 90.5% view IoT as critical

- Food & Beverage: 77.3% prioritize IoT technologies

- Healthcare & Pharma: 80% identify IoT as a top priority

These aren't aspirational goals. They represent active investments and implementations happening across the region.

Germany leads in specific IoT use case adoption. Research from IoT Analytics shows Germany has particularly strong adoption of remote/smart service and maintenance at 50% compared to the global rate of 28%. Predictive maintenance shows 33% adoption (versus 28% globally), and remote asset monitoring demonstrates 33% adoption (compared to 32% worldwide).

A Fraunhofer ISI study from December 2024 found that roughly 16% of industrial firms in Germany integrate intelligent systems directly into their production processes. Large enterprises show even higher rates, with about 30% of factories with 500+ employees now using AI in manufacturing.

Looking at investment trends, 76% of manufacturing organizations express heightened interest in investing in IoT technologies, even amid economic uncertainties. This resilience reflects recognition that IoT isn't optional for maintaining competitiveness.

Key IoT Use Cases Across DACH Manufacturing

IoT implementations in DACH manufacturing cluster around specific high-value use cases:

Predictive Maintenance

Predictive Maintenance leads adoption because the ROI is immediate and measurable. Traditional preventive maintenance follows fixed schedules, often performing unnecessary service while missing actual problems. Predictive maintenance uses sensor data to identify early warning signs of equipment degradation.

Studies show that predictive maintenance can reduce maintenance costs by 30% and spare parts costs by 10%, according to maintenance industry research. More importantly, it can reduce unplanned downtime by 40% and extend equipment lifespan significantly.

For DACH manufacturers, where equipment represents substantial capital investment and downtime directly impacts customer commitments, these improvements justify IoT investments quickly. Many companies find that preventing a single major equipment failure pays for sensors on dozens of machines.

Asset Tracking and Monitoring

Asset Tracking and Monitoring solves visibility challenges in complex, distributed operations. Components might be manufactured in Germany, machined in Austria, and assembled in Switzerland. IoT tracking provides real-time location and condition monitoring throughout this journey, enabling better coordination and faster response to delays or quality issues.

Quality Control and Inspection

Quality Control and Inspection uses sensors to catch defects earlier in production. In pharmaceutical manufacturing (a Swiss specialty), temperature and humidity deviations measured in tenths of degrees can compromise entire batches. Continuous IoT monitoring catches problems that periodic manual checks miss entirely.

Energy Management

Energy Management helps manufacturers meet increasingly stringent environmental regulations while reducing operating costs. IoT sensors track energy consumption by machine, process, or product, identifying inefficiencies and quantifying improvement opportunities. With European carbon taxation becoming reality, measuring and reducing energy use transitions from nice-to-have to business necessity.

Smart Factory Automation

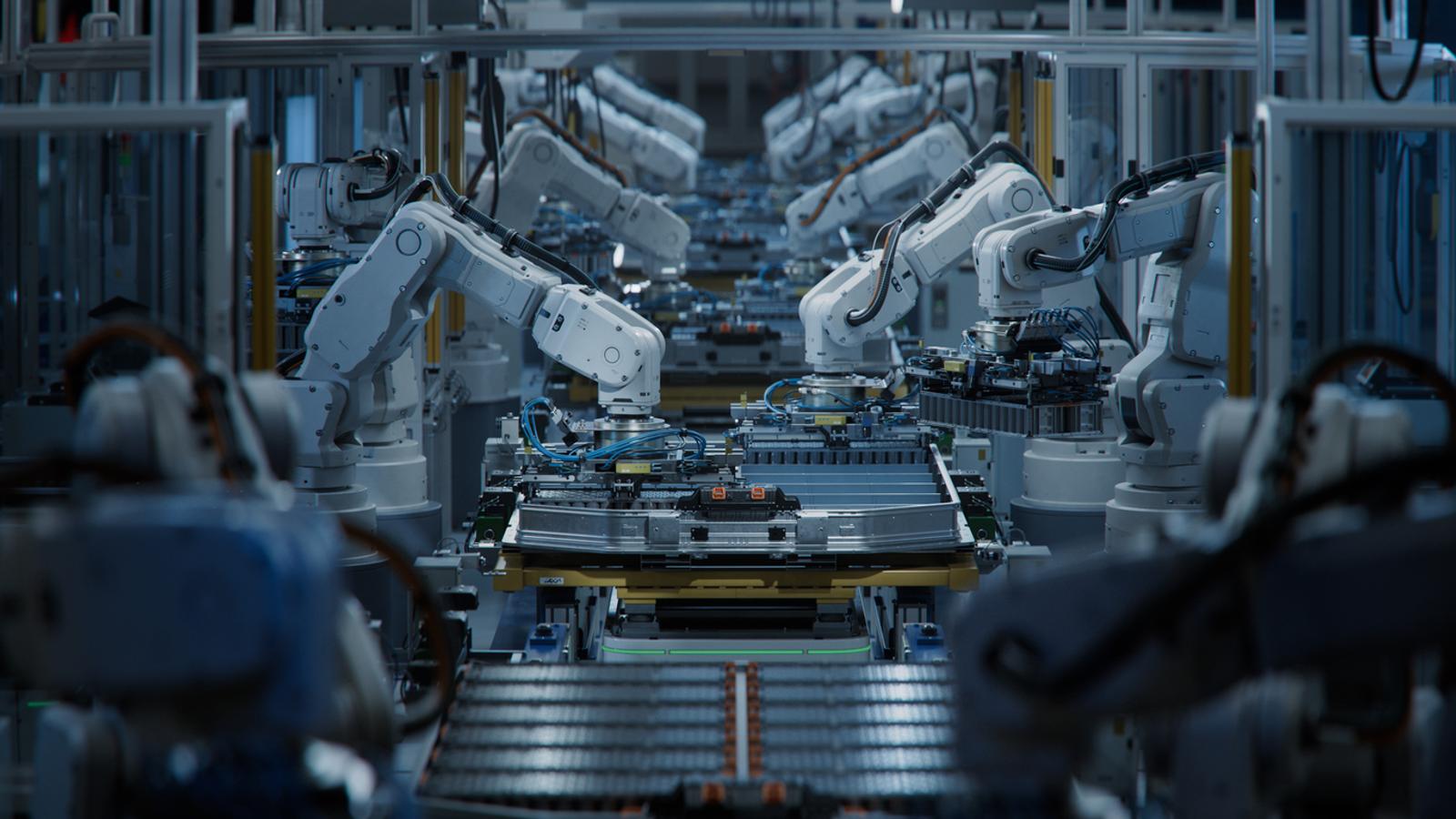

Smart Factory Automation integrates IoT with robotics, AI, and advanced analytics to create truly flexible manufacturing systems. Rather than fixed automation that performs the same task repeatedly, smart factories adapt to changing requirements, optimize processes in real-time, and self-diagnose problems.

Supply Chain Optimization

Supply Chain Optimization extends IoT beyond factory walls to the entire value network. Tracking shipments, monitoring conditions during transport, and coordinating just-in-time deliveries all benefit from real-time IoT data. This becomes particularly valuable for DACH manufacturers serving customers across Europe with demanding delivery requirements.

Real-World Success Stories

Theory becomes reality in the factories where DACH manufacturers have implemented IoT successfully. Three examples illustrate different approaches and outcomes:

Siemens and Sachsenmilch: AI-Powered Predictive Maintenance in Germany

Company: Sachsenmilch Leppersdorf GmbH

Location: Leppersdorf, Germany

Industry: Food & Beverage (Dairy Processing)

Source: Siemens Press Release, 2024

The Operation

Sachsenmilch operates one of the most modern milk processing plants in Europe. The facility processes 4.7 million liters of fresh milk daily (equivalent to 170 truckloads) and produces a variety of products from milk, butter, yogurt, and cheese to dairy derivatives for baby food and bioethanol. The state-of-the-art, almost fully automated facilities must operate 24/7 with nearly 100% availability.

The Challenge

In dairy processing, equipment must operate continuously without interruption. Unplanned downtime can result in spoiled product, missed customer commitments, and significant financial losses. The company needed a way to predict equipment failures before they occurred, particularly for critical assets like pumps that are essential to continuous operations.

The Solution

Siemens partnered with Sachsenmilch to implement Senseye Predictive Maintenance, an AI-powered solution that utilizes machine learning algorithms to identify both immediate and future machine issues. The production environment at Sachsenmilch features modern interconnected machines that generate large volumes of data, creating an ideal setting for predictive maintenance deployment.

The implementation included:

- AI algorithms analyzing real-time equipment data

- Integration with existing production systems

- Training for the Sachsenmilch maintenance team

- Pilot project on critical equipment

The Results

The pilot project delivered immediate, measurable value:

- Early Detection: The system detected a faulty pump at an early stage, preventing a major failure

- Cost Savings: According to Ziepel, "We can confirm that the pilot project with Senseye Predictive Maintenance has already paid off. Detecting a faulty pump at an early stage saved us a lot of expense - in the low six figures."

- Operational Continuity: The facility maintains continuous operation 365 days per year while meeting strict quality standards

- Future Expansion: Sachsenmilch plans to integrate the system with SAP Plant Maintenance (SAP PM) for automated maintenance planning

Key Takeaway

Even a single prevented failure can justify the entire IoT investment. For Sachsenmilch, catching one pump issue before catastrophic failure paid for the predictive maintenance system and validated the approach for broader deployment.

Deutsche Bahn: IoT for Railway Operations

Company: Deutsche Bahn

Location: Germany

Industry: Transportation/Railway

Source: IoT Analytics Germany Market Report

The Company

Deutsche Bahn is Germany's leading railway company and the largest railway operator in Europe. The company operates extensive passenger and freight rail networks across Germany and neighboring countries, requiring massive infrastructure maintenance and operational coordination.

The Implementation

While specific details are limited in public sources, Deutsche Bahn has implemented predictive maintenance systems utilizing IoT technology for:

- Train and locomotive monitoring

- Track infrastructure monitoring

- Signal and switching equipment

- Station facilities management

The Significance

Deutsche Bahn's adoption of IoT predictive maintenance represents a critical infrastructure use case. Railway operations demand extremely high reliability, as failures impact not just one company but entire regional transportation networks. The company's implementation demonstrates:

- IoT viability for large-scale transportation infrastructure

- Integration of predictive maintenance into safety-critical operations

- Government and public sector adoption of Industry 4.0 technologies

Key Takeaway

IoT predictive maintenance extends beyond traditional manufacturing into transportation infrastructure, where reliability and safety are paramount. Deutsche Bahn's adoption signals confidence in IoT technology for mission-critical applications.

What These Success Stories Reveal

Across these three examples, several patterns emerge that define successful IoT adoption in DACH manufacturing:

Start with Clear Business Objectives

Each company identified specific problems IoT would solve. The automotive supplier needed better equipment reliability across multiple sites. The pharmaceutical manufacturer required compliance and quality assurance. The machine tool builder wanted recurring revenue and customer retention. Technology served business goals, not vice versa.

Address Cross-Border Complexity

DACH manufacturers operating across multiple countries face connectivity challenges that domestic competitors don't encounter. Successful implementations specifically address roaming restrictions, regulatory compliance, and multi-carrier management rather than assuming domestic solutions will work unchanged.

Integrate with Existing Systems

None of these companies replaced their entire technology stack. They integrated IoT with existing ERP (particularly SAP, dominant in DACH), maintenance management systems, and quality management processes. IoT enhanced existing workflows rather than requiring complete process redesign.

Focus on Quick Wins

Each implementation delivered measurable value quickly. The automotive supplier prevented equipment failures. The pharmaceutical manufacturer avoided batch losses. The machine tool builder created service revenue. Quick wins build momentum and justify further investment.

Plan for Scale

While starting small, successful companies designed for eventual expansion. The automotive supplier could add more sensors to more machines. The pharmaceutical manufacturer could extend monitoring to more facilities. The machine tool builder could expand services as more equipped machines shipped. Pilot projects proved concepts, but architecture supported growth.

Build Internal Capabilities

Rather than treating IoT as pure outsourcing, successful manufacturers developed internal expertise. They trained maintenance technicians to interpret sensor data, engineers to use analytics tools, and operators to respond to IoT alerts. Technology transfers knowledge, creating lasting competitive advantages.

The Path Forward for DACH Manufacturing

IoT adoption in the DACH region reflects the manufacturing culture that built these countries' industrial strength: careful, quality-focused, and engineering-driven. Rather than rushing to implement every new technology, DACH manufacturers evaluate carefully, pilot thoroughly, and scale systematically.

This approach may appear slower than Silicon Valley's "fail fast" mentality. But it produces sustainable implementations that deliver consistent value over decades, not months. For an industry where equipment lifespans measure in decades and quality reputation takes generations to build, this careful approach makes sense.

The gap between large enterprises and the Mittelstand is closing. As success stories proliferate, government support expands, and connectivity costs decline, more SMEs are taking the IoT leap. The manufacturers that move now gain competitive advantages that will compound over time: better reliability, higher quality, lower costs, and deeper customer relationships.

The question facing DACH manufacturers isn't whether to adopt IoT. It's how quickly they can implement it effectively while maintaining the quality and precision that defines their brands.

FAQs About IoT Adoption in DACH Manufacturing

What makes DACH manufacturing different from other regions?

The DACH region combines several unique characteristics. First, the dominance of the Mittelstand (family-owned SMEs) means decision-making focuses on long-term sustainability over short-term gains. Second, quality standards are exceptionally high, with reputations built over generations. Third, many manufacturers operate across all three countries, creating cross-border coordination requirements. Finally, the region has strong government support for Industry 4.0 through initiatives like Germany's Mittelstand 4.0 Competence Centers and Austria's IoT4CPS program.

How long does it take to see ROI from IoT implementations?

Based on the case studies and industry research, most DACH manufacturers report measurable ROI within 3-6 months of deployment. Many find that preventing just one or two major equipment failures or batch losses justifies the entire IoT investment. However, ROI depends heavily on starting with high-impact use cases (typically predictive maintenance on critical equipment) rather than trying to instrument everything at once.

What are the most popular IoT use cases in DACH manufacturing?

Predictive maintenance leads with 33-50% adoption, followed by remote monitoring and asset tracking. Quality control and inspection are particularly important in pharmaceutical and automotive manufacturing. Energy management is growing rapidly as sustainability requirements increase. The common thread is that successful use cases deliver clear, measurable business value rather than implementing technology for its own sake.

How do DACH manufacturers handle data privacy and security concerns?

GDPR compliance is taken very seriously in Germany and Austria, while Switzerland has similar requirements under its Federal Act on Data Protection. Manufacturers typically implement end-to-end encryption, network segmentation separating IoT from corporate IT systems, and strict access controls. Many choose IoT platforms with EU-based data centers to ensure data sovereignty. The cultural emphasis on engineering rigor and risk management means security is built into implementations from the start rather than added later.