Powering the future: DACH leads the green and digital energy transition

Explore how the DACH region (Germany, Austria, and Switzerland) is spearheading Europe's energy transition, leveraging advanced grid tech, a massive renewable buildout, and IoT to achieve net-zero goals.

The DACH region—Germany, Austria, and Switzerland—represents one of the most dynamic energy markets in Europe, where ambitious decarbonization goals meet some of the world's most advanced grid infrastructure. It's also where the future of utility digitalization is being built in real time.

This blog provides an overview of each country's approach, renewable energy trends, and the IoT connectivity opportunities emerging as utilities modernize their operations across all three countries.

Inside the energy and utilities market in the DACH region

The DACH region (Germany, Austria, and Switzerland) is undergoing one of the most significant energy transformations in Europe. The sector here is defined by a strong push toward decarbonization, massive growth in solar and wind power, smart grid technology investments, and early-stage hydrogen infrastructure development. At the same time, utilities are phasing out nuclear and coal while working to keep the lights on and prices manageable.

What actually counts as "energy and utilities" in this context? The sector covers electricity generation and distribution, natural gas supply, district heating networks, water services, and the growing digital infrastructure that ties everything together. That includes everything from offshore wind farms in the North Sea to the smart meter installed in a Munich apartment.

How the DACH region is driving its energy transition

The DACH energy market is in the middle of a major investment cycle. Decarbonization mandates, energy security concerns after recent geopolitical disruptions, and falling renewable technology costs are all pushing growth forward. What sets the DACH region apart is the combination of high industrial energy demand, strict environmental standards, and deep technical expertise. These countries aren't just adopting clean energy, they're developing the technologies and business models that other markets will eventually follow.

The Energiewende (which translates to "energy transition") concept started in Germany but has shaped energy policy across the entire DACH region. At its core, energy transition means moving away from fossil fuels and nuclear power toward renewable sources while keeping the grid stable and electricity affordable.

Each country takes a different approach. Germany has pursued aggressive renewable targets backed by feed-in tariffs and competitive auctions, aiming for 215 GW solar and 145 GW wind by 2030. Austria builds on its hydropower advantage while adding variable renewables like solar and wind. Switzerland emphasizes efficiency and careful planning given its nuclear phase-out timeline.

Germany

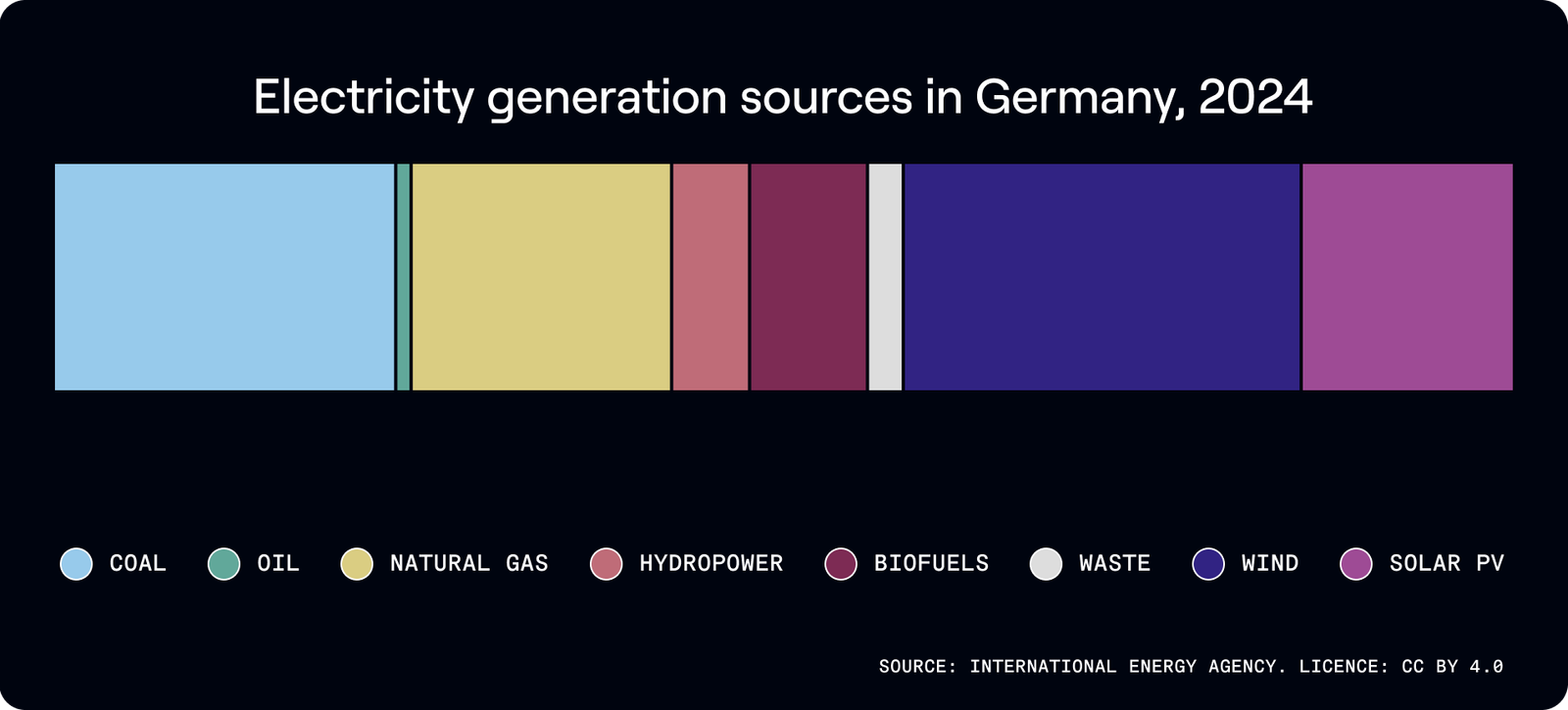

Germany has the biggest energy market in the DACH region, and what they do often sets the pace for European energy policy. Their Energiewende (energy transition) has essentially turned Germany into a real-world lab for figuring out how to run a major industrial economy on a huge amount of renewable energy. They're already getting nearly 60% of their electricity from renewables. The goal is clear: the Climate Law mandates achieving net-zero emissions by 2045. Germany was one of the first countries to invest heavily in offshore wind and solar, and they shut down their nuclear power plants back in 2023. Now, wind is their main electricity source, and the government is pushing hard for massive solar expansion before 2030.To hit their ambitious 2030 targets, they need 80% of all electricity to be renewable (and 100% by 2035), plus a complete coal phase-out.

To make this happen, they've passed major laws on how to plan and site renewable projects, aiming for huge capacities: 100-110 GW of onshore wind, 30 GW of offshore wind, and 200 GW of solar. They're also investing in 10 GW of hydrogen by 2030. On the flip side, their Energy Efficiency Act is all about cutting down how much energy they use. The plan is to reduce consumption by about 500 TWh by 2030, which is roughly a fifth of what they used in 2022. Explore Germany’s energy system.

Austria

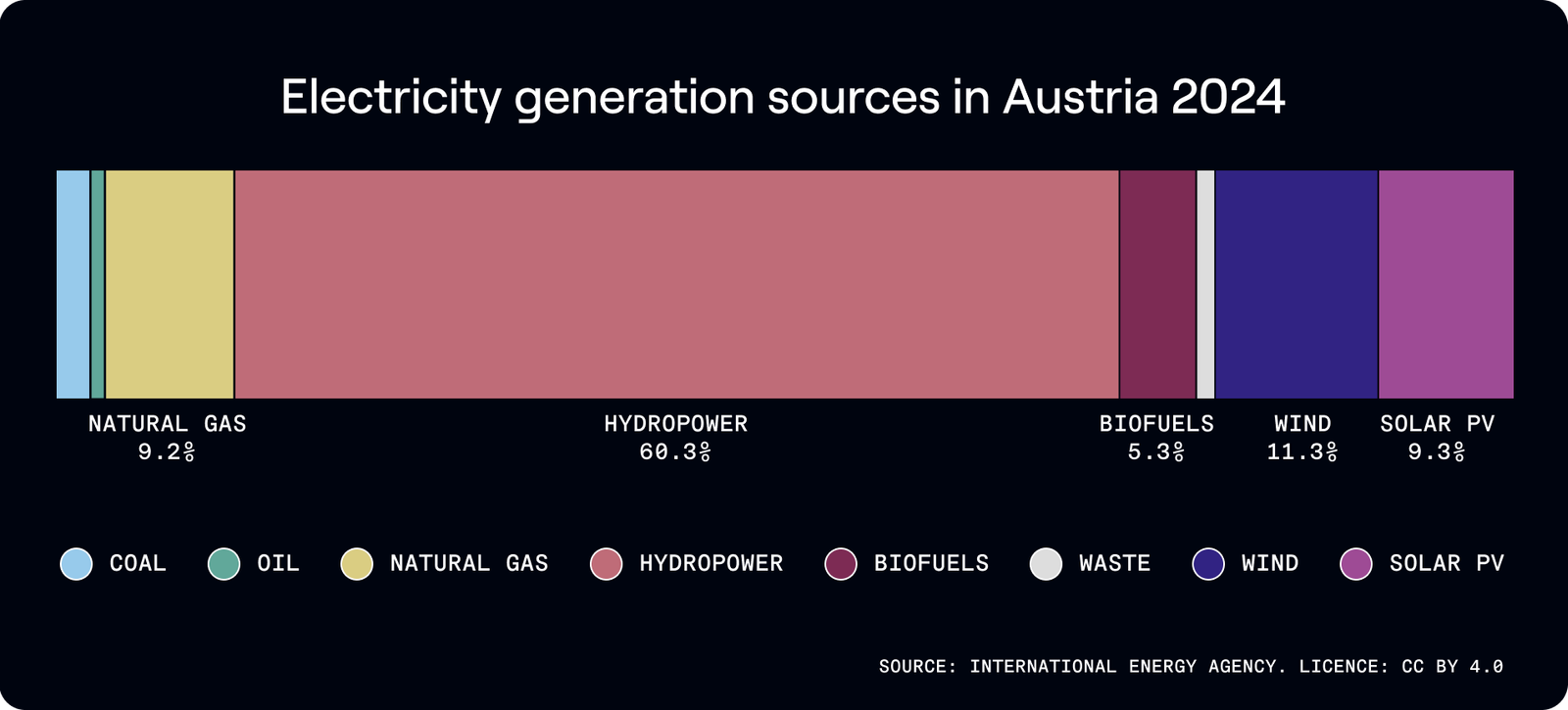

Austria has a huge natural advantage when it comes to energy: their exceptional hydropower resources provide about 67% of their electricity. Plus, Austria acts as an important energy hub, linking Western and Eastern Europe through active cross-border trading. Austrian utilities are also adding solar and wind power on top of their existing hydropower infrastructure.

Austria is committed to hitting climate neutrality by 2040. They're already getting over three-quarters of their electricity from renewables and have set an ambitious goal to reach 100% renewable electricity supply (based on the national balance) by 2030. To get there, they need to invest in making their networks tougher and more adaptable, better managing demand, and updating the rules so consumers can play a bigger role. Since buildings and transport are responsible for around half of all emissions, the government is focusing on supporting building renovations, swapping out fossil fuels for sustainable heating, encouraging electric transport, and investing in public transit. Explore Austria’s energy system.

Switzerland

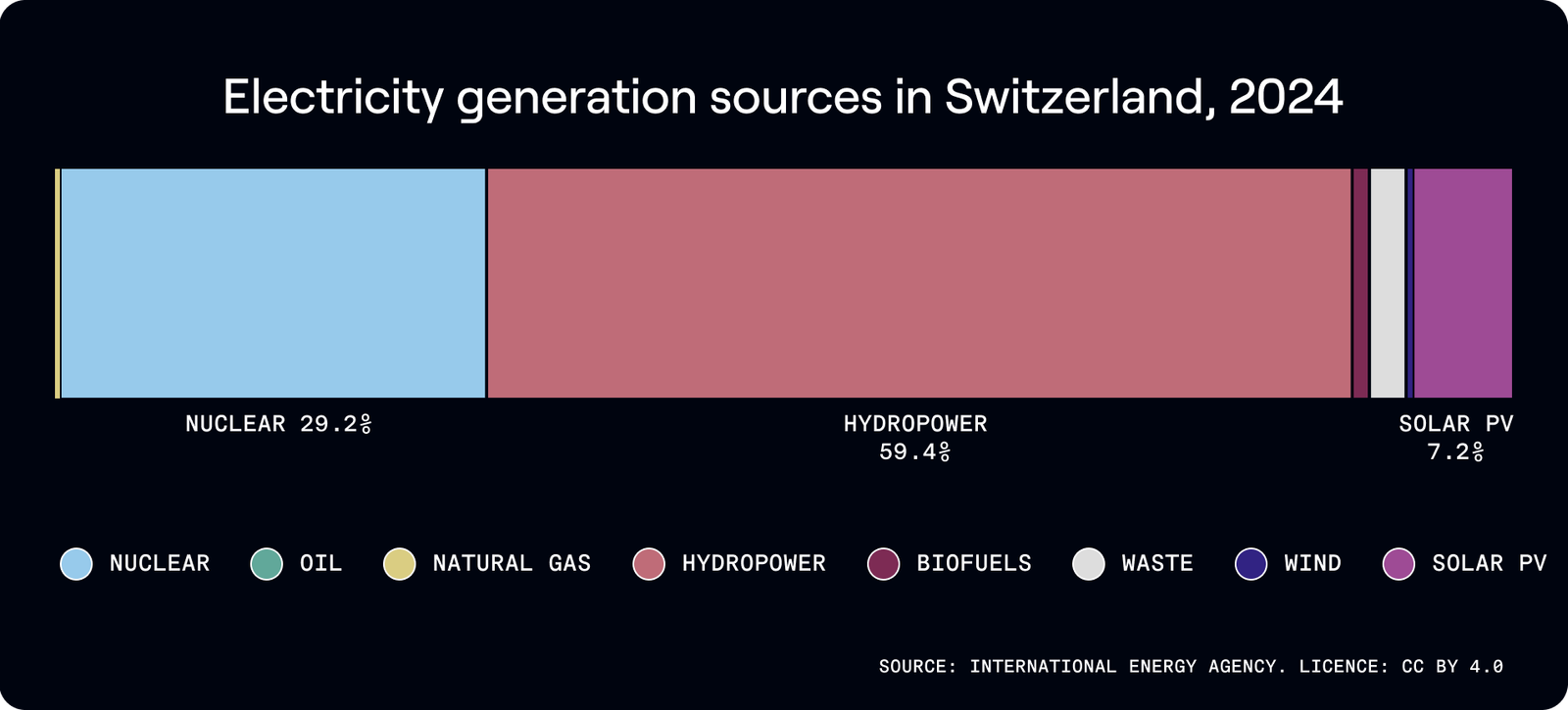

Switzerland faces a more complex path forward after deciding to phase out nuclear power. Historically, their power grid relied mostly on a mix of nuclear and hydro. Now, the official energy strategy is focused on getting more efficient while simultaneously scaling up renewables. Swiss utility companies are even running pilot projects with hydrogen as a way to help their local regions meet decarbonization goals.

It's impressive that Switzerland has managed to keep its economy growing without burning more energy, even with the population expanding. That's a trend that will continue and the idea of "energy efficiency first" is the guiding star for their climate and energy laws. To actually hit their 2050 net-zero emissions goal and close that growing electricity gap they face in the winter when demand outstrips production, they need a massive, unprecedented amount of new renewable capacity, especially from wind and hydro. Explore Switzerland’s energy mix .

Pioneering green hydrogen in Switzerland

H2 Energy is spearheading the green hydrogen revolution in Switzerland by building an ecosystem that supports the energy transition. The company believes that green hydrogen—produced by using renewable energy to split water—is essential for a net-zero future, especially given its versatility for transport, power generation, and industrial processes. To overcome the "chicken-and-egg problem" of supply and demand, H2 Energy formed key joint ventures, notably Hyundai Hydrogen Mobility for fuel cell heavy-duty trucks and Hydrospider for green hydrogen production and logistics.

The AI energy challenge in DACH

AI's impact on energy in the DACH region is a dual dynamic. Germany is already the European country with the most data centers at 490 . More than 100 of them are located in the Frankfurt area alone. AI is a powerful tool for improving energy system efficiency and integrating renewables, yet it also presents a significant challenge by driving massive increases in electricity demand from data centers.

The primary, immediate impact of AI is the surge in power requirements, largely due to energy-intensive AI data centers.

- Exponential growth: AI's electricity demand in Europe is expected to require nearly tripling current capacity by 2030 to reach 150 terawatt-hours (TWh). The International Energy Agency (IEA) projects that global data center energy demand could more than double by 2027 from 2023 levels.

- Grid strain and emissions: This rapid growth is faster than current renewable energy expansion, potentially straining national grids and leading to a continued reliance on fossil fuels like natural gas to meet the shortfall, which can increase consumer costs and hinder decarbonization goals.

- Local impact: Countries with significant data center activity, such as Ireland, are already finding it challenging to meet demand locally, a challenge the DACH nations will likely face depending on the concentration of their AI infrastructure.

However, AI also offers substantial opportunities to optimize the energy sector in DACH and help achieve sustainability goals.

- Renewable energy integration: AI algorithms help manage the complexity of integrating variable renewable energy sources (like wind and solar) into the grid, by improving forecasting, balancing fluctuating loads, and managing distributed energy resources (e.g., batteries and EV chargers).

- Operational efficiency: Energy companies in the DACH region can use AI to improve efficiency in refineries and power plants. Predictive maintenance via monitoring and diagnostic tools helps to deploy maintenance crews more efficiently and reduce operational costs of energy systems.

- Smarter trading: Optimize energy trading algorithms by incorporating historical data and forecasts.

- Data center efficiency: The industry is actively working on solutions to mitigate AI's energy use, including advanced liquid cooling, waste heat recovery, and more efficient AI models, which can reduce cooling energy consumption by up to 20%.

Germany’s AI factory

Deutsche Telekom and NVIDIA have launched the world’s first sovereign, enterprise-grade Industrial AI Cloud, set to go live in early 2026. The partnership combines Deutsche Telekom’s infrastructure with NVIDIA's AI and Omniverse platforms, creating a new "AI factory" based in Germany to accelerate sovereign AI development across Europe.

This platform, powered by up to 10,000 NVIDIA GPUs, including DGX B200 systems, will provide the massive compute power necessary for German industries, including manufacturing, automotive, and healthcare, to deploy advanced AI solutions. According to leaders like NVIDIA CEO Jensen Huang and Deutsche Telekom CEO Tim Höttges, this infrastructure is essential for turbocharging Industry 4.0 and boosting Germany's global competitiveness.

These computers are the modern versions of factories. Just like factories of cars and all the industrial factories of Germany, these are factories of intelligence.

- Jensen Huang, Founder and CEO, NVIDIA

The Industrial AI Cloud is positioned as the first tangible outcome of the "Made for Germany" initiative, gaining strong support from government ministers and key industry players. Major partners, including SAP, Siemens, Mercedes-Benz, and BMW, are already integrating with the ecosystem. SAP will serve as the software-defined backbone connecting the technology to industry, while companies like Siemens will use the platform to accelerate industrial AI adoption, including running complex AI-driven digital twin simulations for automakers.

Renewable energy trends reshaping the DACH market

It's impressive to see how the DACH region—Germany, Austria, and Switzerland—is tackling climate change. While the European Union sets the overarching climate goals, each country is incredibly dedicated to charting its own specific course toward a carbon-neutral future. We're seeing major legislative pushes that are truly reshaping the energy landscape

For example, Germany has its comprehensive Climate Protection Act , Austria is pushing hard with its Renewable Energy Expansion Act , and Switzerland is guided by its long-term Energy Strategy 2050. These aren't just minor adjustments. They are powerful mandates compelling utilities to fundamentally switch to cleaner power sources and operate with unprecedented efficiency. Renewables have moved from niche to mainstream across DACH countries, and the pace of change keeps accelerating as costs drop and policy support strengthens.

Battery storage is taking off

The transition to a cleaner energy future hinges on our ability to manage the inherent variability of renewable sources. As grid operators and utilities increasingly rely on intermittent generators like solar and wind—which produce power only when the sun is shining or the wind is blowing, not necessarily when demand is highest—the requirement for effective energy storage has not just increased; it has skyrocketed.

AC-coupled Battery Energy Storage Systems (BESS) are rapidly transitioning from an ancillary component to standard, essential equipment on virtually every new utility-scale solar and wind farm project. These sophisticated, grid-scale battery installations are the linchpin that ensures energy reliability in a high-renewable penetration grid.

Their primary function is to capture the surplus energy generated during peak production periods—a sunny midday or a windy night—and hold it in reserve. This stored energy can then be dispatched seamlessly onto the grid during periods of low renewable output or high consumer demand, effectively bridging the temporal gap between energy generation and consumption.

The integration of BESS allows renewables to provide crucial grid services that were historically the exclusive domain of fossil fuel power plants. This includes frequency regulation, voltage support, and providing immediate reserve capacity (known as "spinning reserve"). By offering this flexibility and stability, grid-scale batteries are not just making renewable energy available; they are making it dispatchable and reliable, which is fundamental to the successful decarbonization of the energy sector.

The boom in solar and wind power

When we talk about solar, Germany is definitely the powerhouse, leading all of Europe in the amount of installed solar capacity. Helping to increase that capacity is the wide scale use of bifacial modules in solar projects that capture sunlight from both the front and the back of the panel. Offshore wind is also becoming a massive growth area, especially in the North Sea and the Baltic Sea, although good old onshore wind still provides the largest share of the country's electricity.

In Austria and Switzerland, the focus is on boosting solar, particularly with installations on rooftops and in unique alpine environments. Wind power faces a few more hurdles in these two countries compared to Germany, mostly because of the challenging geography and tougher permitting processes.

Challenges remain

The energy transition is a massive undertaking, and while it's packed with exciting opportunities, it also comes with some seriously thorny challenges that utilities and tech companies in the DACH region are grappling with.

An aging grid

Much of the power grid infrastructure across Germany, Austria, and Switzerland was built decades ago. It was designed for a different era—one with huge, centralized power plants and more predictable energy demand. Now? We're throwing decentralized renewables and two-way power flow into the mix. Getting all that integrated and working smoothly means those old grids need substantial, high-tech upgrades.

Crossing border regulatory issues

Germany, Austria, and Switzerland are close neighbors and have strong economic ties. However,each country has its own distinct set of regulatory frameworks for energy. This fragmentation makes operating across borders challenging and can slow down the deployment of innovative technologies that could benefit the whole region.

Cyber threats

As the grid gets smarter and more digitized, it inevitably becomes a juicier target for cyberattacks. Utilities are pouring money into security, but the attack surface is constantly expanding. We're talking about everything from the smart meters on your house to the complex industrial control systems running the whole show. Staying ahead of the bad guys requires constant vigilance and massive investment.

The role of cellular IoT in the renewable energy transition in DACH

Digital transformation is reshaping the utilities sector. For energy companies in DACH, the IoT network of connected sensors and devices has become a cornerstone of this modernization. At the heart of these IoT innovations? Reliable and versatile cellular connectivity.

Connected asset management

Utilities in the DACH region manage extensive fleets of distributed assets, including transformers, substations, solar inverters, and wind turbines. These assets are often located in remote or hard-to-access areas, making the ability to monitor, track, and manage equipment remotely a game-changer.

Here, cellular connectivity plays a pivotal role. Deployments that cross national borders require networks that go beyond the limitations of single-region carriers. A platform offering reliable cellular connectivity with multi-carrier redundancy, like Hologram's IoT solutions, ensures seamless operation across Germany, Austria, and Switzerland. This eliminates the complexities of juggling multiple carrier relationships and provides operators with a unified solution to maintain uptime and streamline operations.

Cellular connectivity from Hologram allows our wind farm operators to access the data from the sensors and quickly diagnose any potential damage before they become catastrophic. Depending on the wind farm site, the financial savings are 3 to 6 times higher than the cost of our system.

- Matthew Stead, CEO and Co-founder, Ping Monitor

Consumer engagement through smart devices

The traditional one-way energy supply model is giving way to a dynamic, two-way interaction between utilities and customers. IoT-enabled consumer devices such as smart thermostats, home batteries, and EV chargers empower households to participate in demand response programs. These programs, which rely on real-time adjustments of energy use during peak grid conditions, are only as effective as the connectivity between consumer devices and utility systems.

For these initiatives to succeed in the DACH region, robust cellular connectivity is essential. A single IoT SIM with multi-network coverage allows utilities to engage customers across all three countries without worrying about local network incompatibilities. This interoperability not only enhances customer trust but also supports the growing adoption of renewable energy and smart home technologies.

When choosing IoT connectivity for these applications, prioritize solutions with network failover and seamless coverage across borders to avoid fragmentation and improve efficiency.

Grid monitoring and predictive maintenance

Across transmission and distribution networks, IoT sensors are becoming indispensable for grid monitoring. These sensors provide real-time data on grid performance, enabling predictive maintenance practices that detect and address issues before they escalate into costly outages.

Cellular IoT connectivity is vital in making predictive maintenanceviable. With reliable and high-performing connectivity solutions like Hologram's, utilities can ensure that data from remote or urban grid sensors flows uninterrupted to central monitoring systems. Features like latency as low as 50ms and support for predictive analytics tools allow operators to act quickly and reduce downtime risks.

For DACH utilities, IoT-driven digital transformation is unlocking efficiencies, minimizing risks, and improving customer interactions. But this transformation heavily relies on a foundational component: reliable cellular connectivity. Multi-carrier, borderless IoT solutions not only simplify operations across Germany, Austria, and Switzerland but also ensure the consistent performance needed to build a smarter, more sustainable energy ecosystem. Whether it's connecting assets, enabling consumer engagement, or ensuring grid health, cellular connectivity is the thread that ties modern utility operations together.

Smart grids and smart meters

The rollout of smart grids across Germany, Austria, and Switzerland is transforming energy infrastructure in the DACH region. By integrating advanced communication technologies, smart grids and smart meters enable dynamic, two-way communication between utilities and consumers, paving the way for more efficient energy management and more responsive services. At the core of this digital transformation lies cellular IoT connectivity, which provides the foundation for secure, reliable, and scalable communication.

Germany's smart meter mandate

Germany’s legal mandate for smart meter installation aims to modernize energy distribution by prioritizing larger consumers and homes with solar installations. With strict regulatory frameworks emphasizing security and data protection, utility providers must ensure that their connectivity solutions not only meet compliance standards but also offer robust encryption and secure data transfer.

Cellular IoT solutions are ideal for meeting these requirements. With features like private APNs and VPN tunnels, cellular connectivity facilitates secure transmission of data from smart meters to utility systems without compromising privacy. Additionally, eUICC-enabled SIMs allow seamless updates to carrier profiles, ensuring compliance with evolving regulations without requiring physical SIM replacements—essential for a large-scale rollout.

Austria's grid modernization progress

Having achieved over 95% smart meter penetration by 2024, Austria is now leveraging cellular IoT to unlock the potential of the vast amounts of data these meters generate. By using reliable cellular connectivity to transfer consumption and grid data in real-time, Austrian utilities are optimizing grid performance, improving energy forecasting, and offering enhanced customer services.

Cellular IoT also enables Austrian utilities to scale their systems without extensive infrastructure upgrades. With multi-carrier redundancy ensuring optimal network performance, utilities can confidently roll out advanced applications, such as real-time consumption monitoring and dynamic load balancing, without the risk of outages or connectivity failures.

Switzerland's smart infrastructure initiatives

Switzerland is integrating smart metering into its broader grid modernization initiatives as part of its federal energy strategy. In early pilot projects, utilities are exploring advanced IoT applications, including dynamic tariffs and automated demand response systems, to enhance efficiency and grid stability. These systems require low-latency, reliable connectivity to ensure real-time communication between smart meters, utilities, and consumer devices.

Cellular IoT is perfectly positioned to support these innovative applications, with features like low latency (as low as 50ms) and nationwide coverage. Solutions like Hologram’s multi-network SIMs provide uninterrupted connectivity across Switzerland, even in remote mountainous regions, ensuring smart infrastructure performs flawlessly, no matter the location.

Opportunities for technology providers in DACH energy and utilities

The DACH energy and utility sector is undergoing a profound transformation driven by digitalization, decentralization, and sustainability imperatives. Technology providers offering solutions across cybersecurity, predictive analytics, renewable integration, demand response, and beyond can unlock significant opportunities. By addressing industry pain points and enabling regional utilities to scale smarter, cleaner, more reliable energy systems, these providers can secure a pivotal role in the future of DACH energy. The DACH energy markets present genuine opportunities for technology companies capable of assisting utilities with modernization and scaling.

IoT connectivity and fleet management

Utilities deploying thousands or millions of connected devices need scalable, reliable connectivity. Managing IoT fleets across three countries with different carriers and regulations is complex, but platforms that simplify this complexity can capture significant value.

Data analytics and AI for grid optimization

The data flowing from connected devices is only valuable if utilities can act on it. Analytics platforms and AI tools that help grid operators balance supply and demand, predict equipment failures, and optimize asset utilization are in high demand across the region.

Cybersecurity

With the growing adoption of IoT and smart grid technologies, utilities face increased risks of cyberattacks targeting critical infrastructure. Technology providers offering robust cybersecurity solutions—such as intrusion detection systems, encrypted data transmission, and endpoint security for IoT devices—can capitalize on the need to protect sensitive operational data and infrastructure. Compliance with stringent European regulations (like GDPR and NIS2) presents an additional opportunity for specialized solutions tailored to this high-stakes industry.

Energy management platforms

Dynamic energy management systems that include predictive analytics for renewable yield and integrated storage solutions can help utilities stabilize the grid while maximizing renewable adoption. Software and connectivity solutions that work seamlessly across Germany, Austria, and Switzerland—without requiring separate integrations for each market—address a real pain point for utilities operating regionally.

Energy-as-a-Service (EaaS)

With the transition towards decentralized energy systems, there's growing interest in Energy-as-a-Service models that allow utilities and customers to pay for energy usage and optimization services rather than owning and managing expensive infrastructure. Providers offering platforms that enable subscription-based models, manage distributed energy resources, and provide performance-based pricing analytics can tap into this emerging trend.

EV charging infrastructure management

The rise of electric vehicles (EVs) in the DACH region poses both opportunities and challenges for utilities. Technology providers can offer platforms that manage and optimize EV charging networks, help balance grid loads, and integrate EVs as distributed storage assets (vehicle-to-grid, or V2G). Solutions that analyze EV charging patterns and predict demand can help utilities prevent grid overloads while enabling the smooth scaling of EV adoption.

Battery Energy Storage Systems (BESS) integration

Utilities are increasingly adopting large-scale battery storage to balance intermittent renewable energy production and stabilize their grids. Opportunities exist for providers that can offer platforms to manage storage systems, forecast battery life, and model potential savings or revenue from energy arbitrage. Intelligent battery management software can make energy storage more efficient and cost-effective.

Smart infrastructure for cities and utilities

Beyond smart grids and meters, utilities are playing a growing role in smart city initiatives. Technology providers can offer solutions that integrate utilities with broader urban infrastructure—such as smart lighting, water management, waste systems, and public transportation. Platforms that aggregate and analyze multi-utility data for comprehensive urban planning can be a game-changer for municipalities in the DACH region.

Grid edge technology and microgrid solutions

There is significant potential for grid edge innovation, such as microgrids that serve remote communities, industrial parks, or campuses. Technology providers can offer solutions to manage microgrid operations, integrate renewable energy sources, and ensure resilience during grid outages. Intelligent software that coordinates between a microgrid and the broader smart grid offers an opportunity to expand grid flexibility and reliability.

How technology leaders can drive innovation in DACH energy markets

The DACH region is at the forefront of global energy market transformation. With aggressive decarbonization targets, grid modernization efforts, and rapid digitalization, this market isn't just evolving; it's setting benchmarks for innovation worldwide.

For technology providers, success in this dynamic landscape requires more than just offering cutting-edge solutions. Utilities in the DACH region are not merely seeking vendors; they are looking for long-term partners who can simplify complexity and deliver adaptable, future-ready tools. Whether it’s managing connected devices seamlessly across borders, ensuring secure and reliable data transmission from remote energy assets, or enabling scalable deployments without operational bottlenecks, the true market leaders will be the ones who master simplicity in the face of complexity.

As the energy transition accelerates, the infrastructure enabling this shift becomes more critical than ever. Technology leaders with the foresight to address the unique challenges of this market. Reliable IoT connectivity, real-time grid analytics, and cross-border energy solutions will play a pivotal role in shaping the future of the DACH energy sector and beyond. Now is the time to innovate, simplify, and scale alongside a region taking bold steps toward a sustainable energy future.

FAQs about energy and utilities in the DACH region

What is Germany's main source of energy?

Germany relies primarily on a mix of wind, solar, natural gas, and coal for electricity generation. Wind power has become the single largest source, while solar continues to grow rapidly. The country is actively phasing out coal and has already closed its nuclear plants.

How does cross-border energy trading work in the DACH region?

Cross-border energy trading operates through interconnected transmission grids and wholesale electricity markets. Power flows between Germany, Austria, and Switzerland based on price signals, with electricity typically moving from areas of surplus to areas of higher demand.

What connectivity requirements apply to smart meters in DACH countries?

Smart meters in DACH countries require secure, reliable communication for transmitting consumption data and receiving utility commands. Germany has particularly strict requirements through its Smart Meter Gateway specifications, which mandate certified security modules and approved communication technologies.

What are the primary energy companies in DACH?

The DACH energy market includes large incumbent utilities alongside newer, more agile players. Knowing who operates in this space helps explain how the market functions and where opportunities exist for technology providers.

Leading German energy companies

Germany's electricity market was historically controlled by four large utilities that dominated generation, transmission, and retail supply. The market has opened up significantly since then, but these companies remain major forces:

- E.ON (retail and distribution focus)

- RWE (generation and renewables)

- EnBW (integrated utility, strong presence in Baden-Württemberg)

- Vattenfall (Swedish-owned, active in Berlin and Hamburg)

Top Austrian energy providers

Austria's energy landscape features national players alongside strong regional utilities:

- Verbund (largest electricity producer, hydropower specialist)

- OMV (oil and gas, transitioning toward low-carbon operations)

- EVN (regional utility providing electricity, gas, and water)

Key Swiss utilities

Swiss utilities often have significant cantonal ownership and expertise in cross-border energy trading:

- Axpo (largest Swiss energy company, active in European wholesale markets)

- Alpiq (generation and energy services)

- BKW (integrated utility with a growing services business)